Explain the Difference Between a Checking Account and Savings Account

We greatly appreciate the information provided. Balance grows by less than 50 a month regular savings condition is not met.

Checking And Savings 101 Bank Accounts 1 2 Youtube

How to Check LIC Policy Status Details Statement via OnlineSMSCall.

. Restricted cash should be recorded in a different account Cash Accounting. Grow Your Money At 6x The National Average A perfect account for those just starting out with their savings By Nicole Spector. Retirement income account investing in annuities or mutual funds for religious organization employees.

It comports with my logic that with auto-deposits and auto-pay activities. Withdrawals may be made from an Online Savings Account although there are certain restrictions compared to a checking account as described later in this Agreement. 1152 am on October 14 2016.

Upon checking their website states that you can earn high interest with a Savings Builder account. Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned. What Is the Difference Between a Checking Account and a Savings Account.

A money market account sometimes called a money market deposit account or a money market savings account is an interest-bearing account that acts like a hybrid between a checking and savings account. An Online Savings Account allows you to make deposits by check ACH Transfer ACH Transfer wire transfer or transfer from another Account you maintain at the Bank. It is the primary source of funds for an individual where cash.

This savings account compounds interest every month. Interest is paid monthly and. The amount of this deposit typically serves as the credit limit for.

It offers regular checking accounts and a variety of savings products like CDs and retirement accounts in addition to the residential mortgages that. On the other hand 401a plan options typically include mostly mutual fund investments. If inflation goes up by 62 per cent between now and next year choosing a savings account paying between 1 and 2 per cent effectively means reducing the impact of inflation on your own savings by.

On June 15 2015 Estate Planning Basics 91 Comments. Still most 403b plan investment menus tend to offer annuity options from insurance companies. Student accounts may have reduced fees and special features.

Savings interest is paid tax-free and most wont pay any tax on it at all. You have 100000 in your savings account which has an APR of 5. A checking account is meant to be used for daily cash needs.

A current asset account which includes currency coins checking accounts and undeposited checks received from customers. Apart from this security deposit secured and unsecured credit cards arent necessarily better or worse for your credit. A savings account is simply an account for you to put money in and earn interest.

When almost after a month he came to LIC of India office to renew his expired policy he was. There are many types of savings account with NatWest. CIT Bank Money Market Account Review.

Rajiv Verma bought a Child LIC policy to provide financial security for his kids future. A student bank account is a checking or savings account that a bank credit union or other financial institution offers to students. However due to time constraints or negligence he forgot to pay its premium and missed the grace period too.

The amounts must be unrestricted. If your balance grows by 50 a month regular savings condition is met. Once youve got the savings part down you could try your hand at investing to potentially benefit even more compound interest.

Depending on your financial institutions requirements you may have to maintain a minimum balance or put down a minimum deposit amount to open this type. The main difference between a secured credit card and an unsecured credit card is that secured cards require you to place a refundable security deposit when you open your account. If you dont have a problem with the checking account the savings and safe deposit box will go down easily.

Custodial account that invests in mutual funds. In the end the difference between monthly and daily compounding is. Basic-rate taxpayers can earn 1000year tax-free and higher-rate taxpayers 500 so its only those with very large amounts of savings who would need to worry about this and thats less than 5 of us.

For example lets say you opened an investment account with the help of an adult you usually need to be 18 years or older to invest. If you contributed 100 per month to the investment account for 40 years and.

Checking Vs Savings Account Which Do You Need Dollarbreak Savings Account Savings Account Interest Finance Saving

What Is The Difference Between A Checking And Savings Account Savings Account Online Bank Account Opening A Bank Account

Kal Penn Explains The Difference Between Checking And Savings Accounts Savings Account Accounting Explained

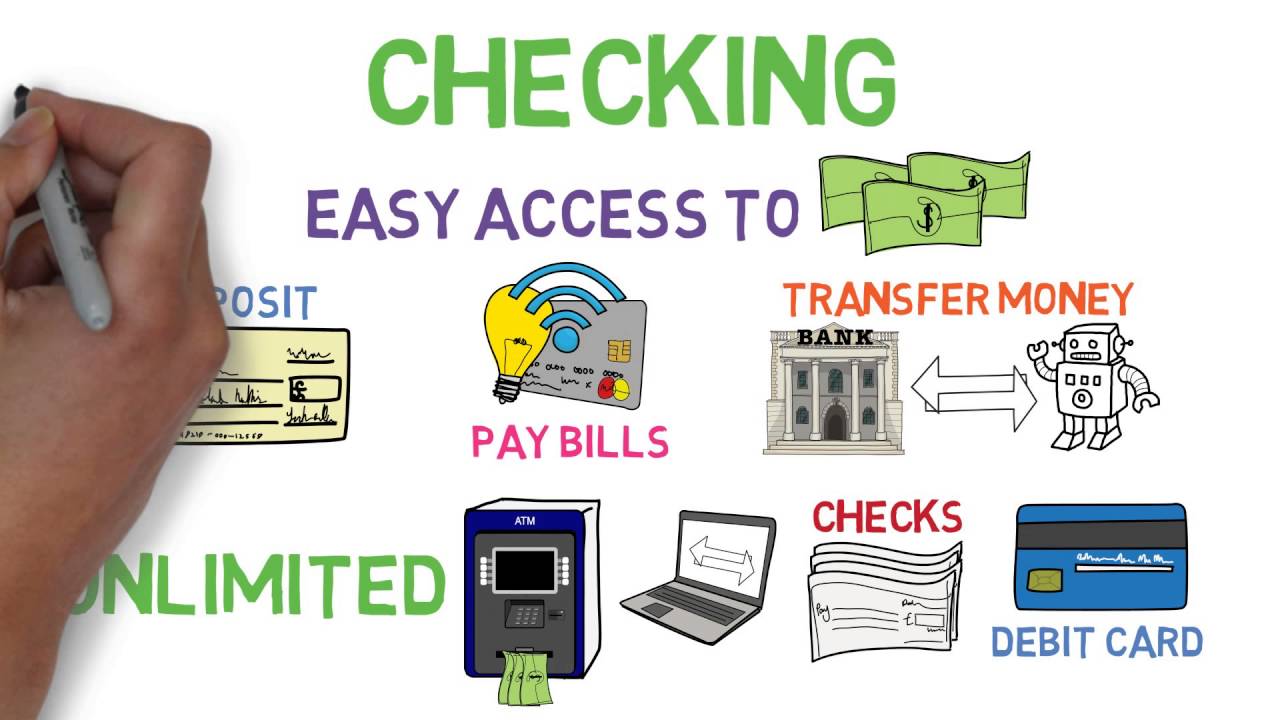

What Is A Checking Account Savings Account Investing Checking Account

No comments for "Explain the Difference Between a Checking Account and Savings Account"

Post a Comment